Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

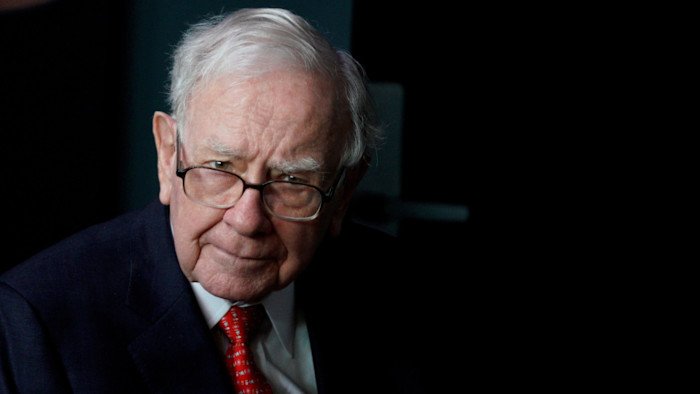

Warren Buffett has handed over Berkshire Hathaway’s reins after six decades at the helm, in one of the most consequential corporate successions of a generation.

Berkshire vice-chair Greg Abel, 63, took charge as chief executive on Thursday, leaving a low-profile protégé of one of history’s savviest investors to lead the sprawling company.

Buffett, 95, transformed Berkshire from a struggling New England textile mill into a $1.1tn financial behemoth that spans railroads, utilities and insurance operations.

With Buffett promising to go “quiet”, Wall Street is watching to see how Abel will deploy Berkshire’s vast portfolio.

The company has more than $350bn of cash and short-term Treasuries and $283bn in publicly traded stock. Investors will also scrutinise how Abel allocates the almost $900mn of cash that flows in from its businesses each week.

“He’s inheriting the most privileged place in American business,” said Christopher Davis, a partner at Berkshire investor Hudson Value Partners. “Buffett was not only a great investor but someone people . . . looked up to for doing the right thing and dealing fairly and that gave Berkshire some pretty broad latitude.”

Investors have more questions than answers as they wait to see how Abel, a longtime Berkshire executive, begins to leave his mark. They are keen to see whether he will hew to Buffett’s value investing philosophy, which in recent years has meant Berkshire has passed on several big-ticket deals and avoided many flashy tech investments.

Some analysts and investors have also pressed Buffett to launch quarterly earnings calls or provide better qualitative insight into how individual units are performing — a decision that now rests with Abel.

The new CEO has only seldom made himself available to the press and investors.

Shareholders have instead drawn on his comments at Berkshire’s annual meetings in Omaha, Nebraska, for clues on how he will size up investment opportunities and the business attributes he will be looking for when going elephant hunting — Buffett’s term for the group’s mammoth corporate takeovers.

Abel, a Canadian who rose up through Berkshire’s utilities division, has signalled the company’s investment philosophy will not change when he takes over.

Last year he told investors he would continue to target businesses that generate significant cash flows and the company’s long-term investment horizon would remain intact.

Investors are waiting to see if Greg Abel, centre, will continue to use Warren Buffett’s annual shareholder letter in February to lay out his vision for Berkshire © Brendan McDermid/Reuters

He added Berkshire would still need to have a view on the economic prospects of a company in 10 or 20 years before investing, whether buying a business outright or when purchasing a minority stake.

“It is really the investment philosophy and how Warren and the team have allocated capital for the past 60 years,” Abel said last May. “It will not change and it’s the approach we’ll take as we go forward.”

He declined to comment for this story.

Each February investors and corporate executives pore over Buffett’s annual shareholder letter. Buffett has said he will not be writing the next missive, and investors are waiting to see if Abel will use the annual letter to lay out his vision for Berkshire.

Investors are particularly focused on whether Abel was involved in Berkshire’s $4.3bn investment in Google owner Alphabet in late 2025, or if it was Buffett who signed off on the wager.

If Abel was a key driver of the investment, then investors could view that as a sign that Berkshire is open to making big bets on fast-growing technology companies.

“What is it in the capital allocation model that just made them decide to buy Alphabet now?” asked Christopher Rossbach, chief investment officer of J Stern & Co, a longtime Berkshire investor.

He added: “What makes Berkshire special is the public equity portfolio. And the question is: is it really going to be Greg managing that in the way that Warren did?”

Abel has begun to leave his stamp on some parts of Berkshire’s sprawling empire. He will be joined by a new chief financial officer next year as well as the company’s first general counsel.

He has also promoted the CEO of fractional jet ownership company NetJets as president of 32 of Berkshire’s consumer, retail and service businesses — a division that generated more than $40bn of revenues in the first nine months of 2025.

Recommended

Investors such as Darren Pollock, a portfolio manager at Cheviot, said they saw the appointments as a step by Abel to fill in gaps at Berkshire’s slim home office in Omaha, which at the end of 2024 employed just 27 people.

“This paves the way for Greg’s larger priority — to win the confidence of shareholders who can’t help but be less comfortable with Abel than they are [with] the legendary Buffett,” Pollock said.

“Now, with the spotlight on him, Abel needs to show what people within Berkshire know him to be: a steady and razor-sharp leader.”